Loan participations aren’t new, but they have evolved over time. Between technological innovations and growing adoption by credit unions and other financial institutions, this balance sheet strategy has become easier to deploy than ever before — just in time, it seems, for today’s challenging balance sheet environment.

Here are three key points for credit unions and banks to know about loan participations today.

1. Credit unions and banks need loan participations

In today’s economic environment, where financial institutions are flush with deposits but have limited access to new loans, loan participations can be an effective way for credit unions and banks to manage their balance sheets and drive both interest and non-interest income.

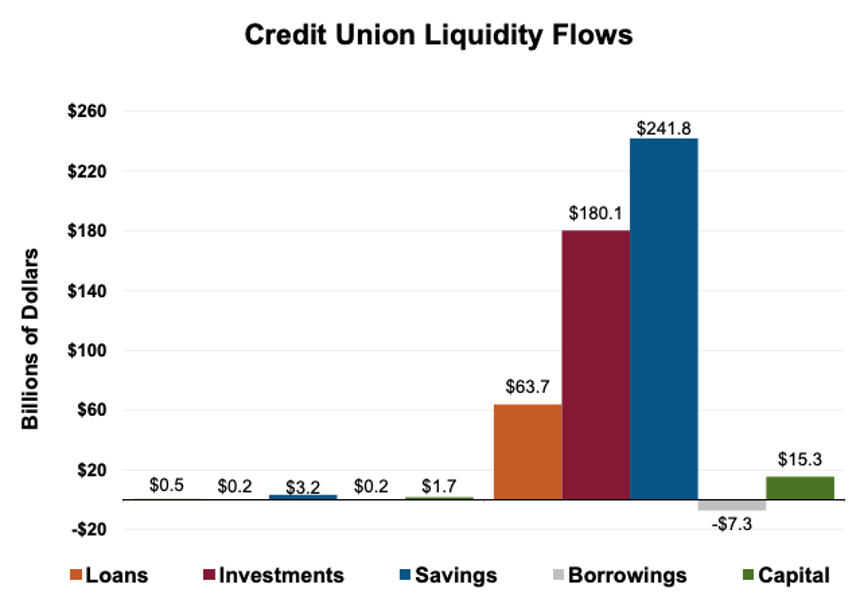

At the end of November 2020, loan-to-asset ratios for the credit union industry stood at 64.2%. Meanwhile deposits grew 18% last year, while loans only grew by 5.7% — below the 7.2% long-run average. Clearly, loan originations are not keeping pace.

As deposit bases swell, interest rates remain low, and origination opportunities face challenging growth prospects, credit unions and banks should consider the increasing benefits of loan participations. Participations allow the sharing of loans among multiple institutions, giving credit unions and banks access to new, diversified assets.

2. Loan participations have become easier to execute

Many financial institutions equate loan participations with their historical pain points. Traditional loan participations are facilitated by brokers in one-off transactions, making it burdensome for sellers to service participations for multiple buyers and for buyers to consistently access assets available for purchase. As a result, many credit unions and banks have stayed out of the market because they lack the resources and in-house expertise to oversee and locate these types of programs.

Fortunately, loan participations have come a long way in the past decade, with LendKey at the forefront of that evolution.

LendKey began serving clients in the wake of the Great Recession, when credit unions and banks were flush with deposits but had few opportunities to grow originations or accumulate assets — a similar environment to today. Since then, LendKey has spent the past decade optimizing its managed loan participation programs, culminating in the recent launch of ALIRO, a private deal network for buying and selling loans.

ALIRO is designed to streamline the loan participation process, making participations a more viable option for credit unions and banks of all sizes. By providing much of the onboarding and diligence documentation directly on the platform, loan participations conducted on ALIRO tend to involve less paperwork and transaction costs. These advances create a virtuous cycle where more credit union and bank buyers can take advantage of loan participations, driving more asset originators to enter the participation market, increasing the variety of loans available and making it easier for credit unions and banks to diversify their portfolios.

In addition, financial institutions on the ALIRO platform can more easily transact in smaller sizes — amounts as low as $1 million are not uncommon. This can be helpful for smaller institutions and/or participants who are looking to test the waters on a new type of asset or loan program.

3. Recurring “forward flow” transactions are revolutionizing the loan participation space

In addition to reducing the friction inherent in traditional loan participations, ALIRO has improved the process even further by creating “forward flow.”

Credit unions and banks can think of forward flow as similar to a subscription. The seller subscribes to a steady stream of demand for participation in interest-bearing investments, and the buyer subscribes to a steady stream of payments that fit its credit policy and risk requirements. The result is increased income and ongoing balance sheet visibility for both parties. You can learn more about forward flow here.

Loan Participations: An Evolving Tool for Balance Sheet Management

Loan participations remain an important tool in today’s lending environment, just as they were a decade ago. Fortunately, many of the drawbacks associated with participations — such as ongoing accounting, reporting, and payment remittance obligations — have been greatly reduced by platforms like ALIRO, allowing more participants to enter the market and increasing the usefulness of participations to a larger number of credit unions. ALIRO’s forward flow system further capitalizes on these changes by creating a visible stream of loan supply and demand to the benefit of participation originators, buyers, and sellers alike.

Contact our team to learn more about the ALIRO network.