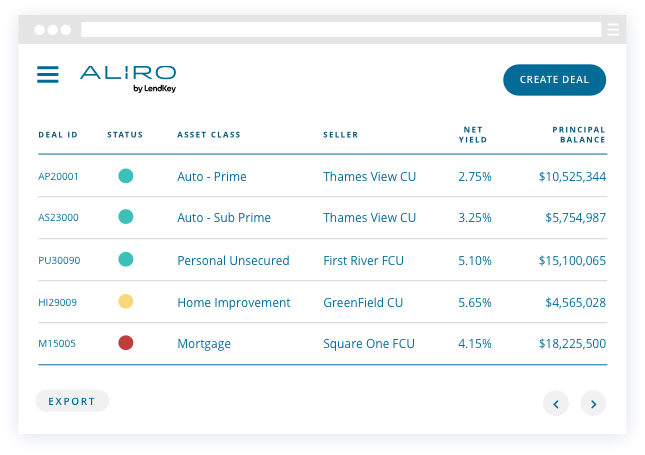

At LendKey, we’re all about creating access. As a pioneer in digital loan participations, we’ve spent over a decade refining and optimizing our approach in order to eliminate some of the costs and administrative friction inherent in traditional loan participations. Today, credit unions and banks of all sizes can leverage loan participations via ALIRO, a private deal network for buying and selling loans.

In addition to alleviating logistical and financial hurdles, we also saw an opportunity to create more certainty for loan buyers and sellers — through a unique, proprietary system we call “forward flow.” Forward flow enables asset buyers to commit to loan purchases from a seller before the loans are originated. The result is increased income and balance sheet predictability for both parties.

Credit unions and banks can think of forward flow as similar to a subscription. Buyers subscribe to a steady stream of assets that fit a pre-approved set of credit requirements, and the seller enjoys stable liquidity by distributing loan production to a network of participant purchasers with pre-committed, regular purchase amounts.

How Forward Flow Benefits Asset Buyers

Through forward flow, buyers receive a regular cadence of loan volume, consistent with their desired purchase commitment for each time period (e.g., once per month). This bundling process intentionally reduces ongoing diligence frictions. After initial diligence on the asset and seller has been completed, buyers can confidently and effortlessly supplement their balance sheets without relying on potentially challenging organic originations, over-subscribed, bespoke portfolio purchases, low-yield investments, or expensive alternatives with inferior returns. Performance reporting and transaction documentation is automated and delivered reliably for the life of the asset.

Since buyers’ purchase commitments are aggregated by ALIRO, their purchasing power represents a much larger opportunity to asset sellers opening access to transactions that otherwise would have been reserved for only large acquirers. For credit unions, participations also allow for the purchase of assets without the need to complete a potential burdensome and restrictive membership process.

How Forward Flow Benefits Asset Sellers

Meanwhile, sellers participating in forward flow receive a regular cadence of guaranteed loan purchases by trade-ready buyers. Sellers can acquire or originate loans with confidence as their participation buyer syndicate grows over time, allowing for larger investments in direct marketing and customer acquisition as well as a substantial opportunity to grow non-interest income via gain on sale.

Often, the primary limitation of selling participations and growing a buyer network is the administrative burden, including ongoing performance reporting, payment remittance, and generation and distribution of accounting documentation. While typically desired, a forward flow structure introduces a regular cadence of new administrative tasks that can be debilitating if un-automated. With ALIRO, loan participations are made accessible and scalable even by those with no experience.

ALIRO’s forward flow increases the ease with which credit unions and banks can join in loan participations and increases the diversity of the types of loans available. By creating a more stable stream of loan volume for both buyers and sellers, forward flow allows financial institutions to fully benefit from new opportunities in the loan participation marketplace.

If you’re interested in discussing how forward flow and loan participations could work for your institution, let us know here.